The sudden surge in bitcoin last night was as fierce and it looks like sellers are losing the tug-of-war

Xbit placed a long position at around $9830 and closed the position at around $10,300. The chart below shows our Bitmex account at around midnight last night. The green dotted line indicates our entry price and the red line indicates current value at the time of screen capture.

The market is in a very strong bull trend

Don’t get too caught up in what caused the recent price spike. It doesn’t really matter what triggered the spike – however I’d like take a moment to walk you through how we decided to take our latest long position.

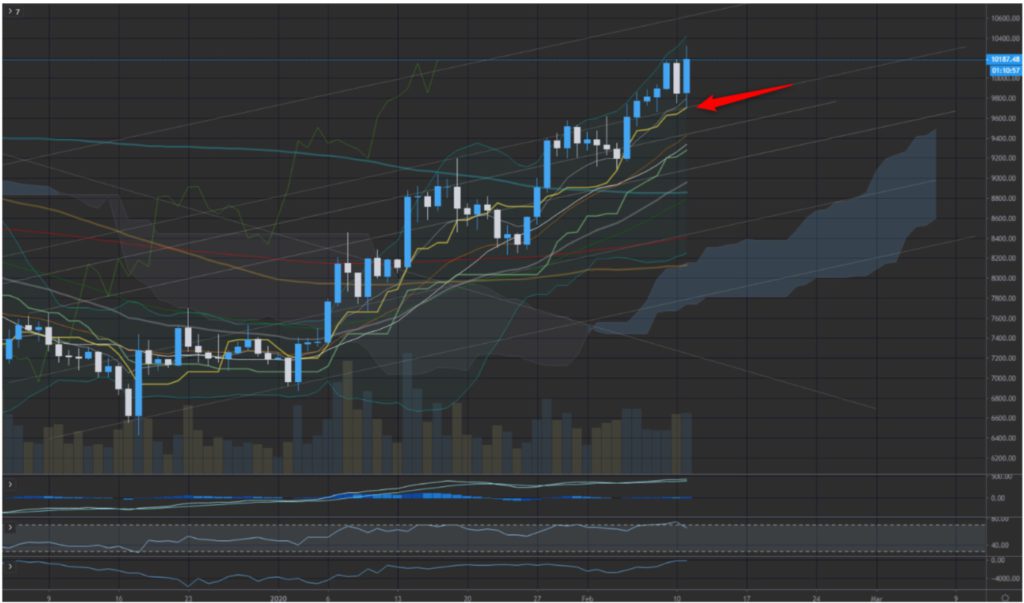

Our trading principles are relatively simple. First, we confirmed the continuation of the current strong bull trend. Based on that initial premise, subsequent buy and sell decisions were made according to indicators of market trend speed – the Ichimoku balance table being the most influential for us. If you want to trade a medium to long-term trend, it’s critical to look for a situation like last night where bitcoin’s price was trading close to the base line of the Ichimoku balance table (see the daily chart below) before rebounding. Of course the trend needs to be confirmed by other indicators, but these are the starting points when looking for an attractive entry.

Reasons for closing our long position and future developments

We closed the position for a simple reason – the price was accelerating too fast. Xbit signaled we might be a little overbought. I won’t lie to you – taking profit when prices are soaring is very difficult – we’re only human, after all. As I’ve said many times before, staying calm and trading without emotion is the most difficult skill to learn.

I think there’s a good chance we will see more action this weekend. However, as usual we will wait for prices to settle closer to the Ichimoku cloud before taking a long position again.

No one has a crystal ball, but I have a strong feeling we will see prices rise to somewhere around $40-50,000 this year, significantly surpassing the December 2017 highs of $ 20,000. I don’t see a lot on TV or print media in Japan but I’m confident demand for bitcoin is slowly ratcheting up as attitudes surrounding cryptocurrencies continue to evolve.

Since October last year, I’ve payed approximately 60% of my corporate expenses using bitcoin. Clearly, vendors all over the world have become more comfortable receiving payment in bitcoin. Anecdotally, when I was shopping for a high-end, customizable keyboard, I was pleasantly surprised to see an option to pay with bitcoin. As velocity of circulation rises, so will bitcoin’s price. (New keyboard below).